13

FUELS & LUBES INTERNATIONAL

Quarter Three 2014

For European refiners,

the competition is very steep with

more exports coming in and fewer

import destinations for their fuels and

base oils, according to Libby George,

deputy editor of Argus Base Oils,

who spoke at the UNITI Mineral Oil

Technology Congress in Stuttgart,

Germany in April.

“The refining evolution is putting

more pressure on Europe,” she says,

“with global refining capacity increas-

ing in the Middle East Gulf, in Asia

and in the United States.”

Feedstock cost advantages in these

regions are also putting pressure on

European refiners, and changing

global demand is curtailing consump-

tion in some of the markets that are

very important for Europe on the fuel

side, such asWest Africa, she says.

In the last six quarters prior to the

end of 2013, European refinery runs

have been declining while American,

Middle Eastern and Asian refinery

runs have been growing.

George attributes this trend to the

shale revolution in the U.S., which is

driving down feedstock costs in the

U.S. In the past, the U.S. was a key

outlet for European gasoline—from

2006 to 2010, the U.S. was a net

importer of gasoline—but because

American consumption is not grow-

ing, U.S. stocks need to find a home in

other markets.

“Americans are buying fewer cars

and are driving more fuel-efficient

vehicles,” she explains.

But U.S. refiners are producing

more jet fuel, middle distillates and

gasoline. Thus, quite a lot of middle

distillates ends up in the European

market, especially in 2013, and U.S.

gasoline also competes with European

gasoline in some markets, such as in

Nigeria. “This market had been key

to Europe for gasoline exports. Now,

the U.S. is trying to elbow out Europe,

which also cuts into European

margins.”

In the meantime, Indian refining

capacity has increased by 50% in

the last five years, which has turned

the region into an export hub. “This

means Asia has been cut off as a net

importer of gasoline and diesel. This

has also put pressure on European

margins,” says George.

“Europeanmargins are substan-

tially lower, and there is no silver lin-

ing,” she adds. “Shale oil will continue

to give the U.S. an advantage and turn

it into a supplier to the world.”

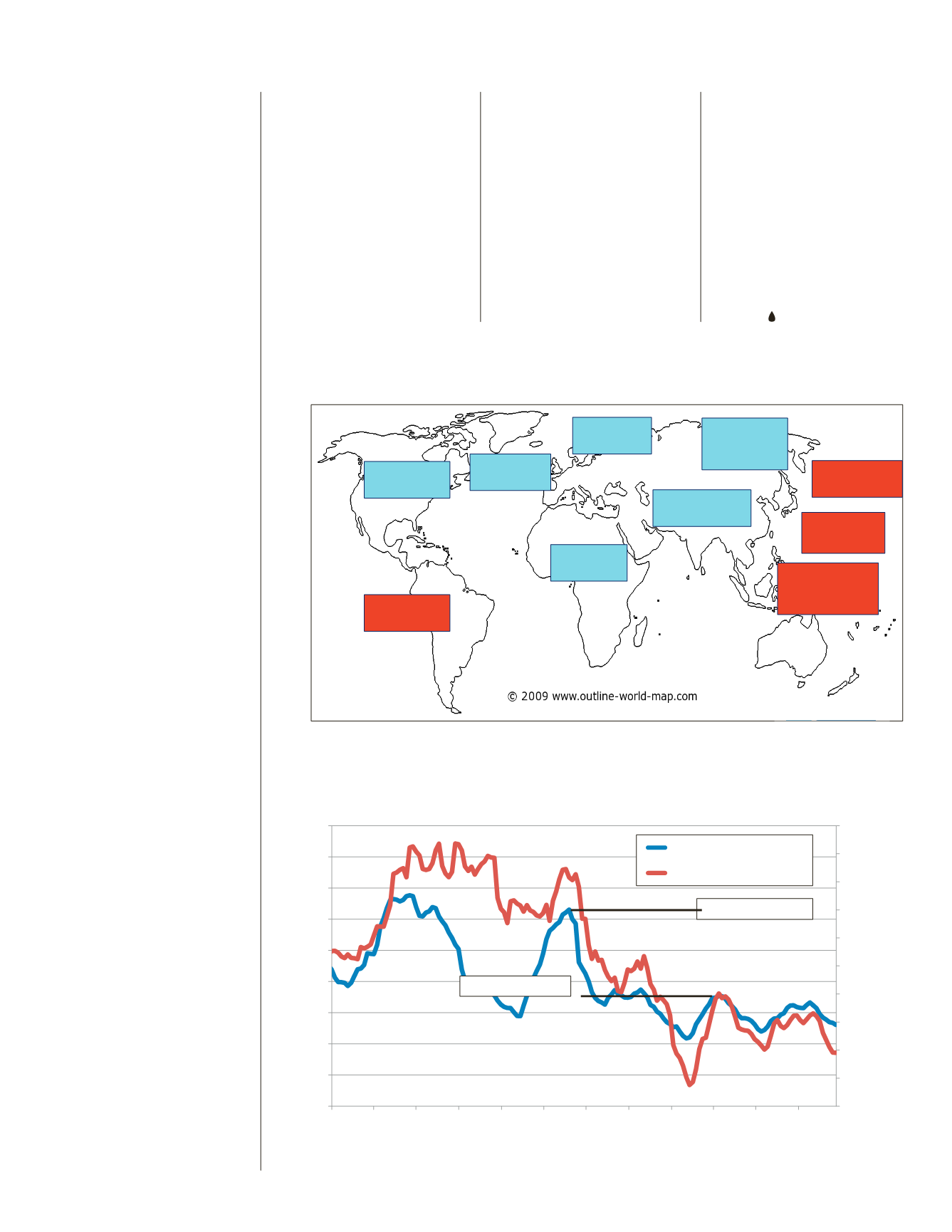

illuminating the markets

Capacity in 2014 to rise by more than 3.5mn t/yr

Copyright © 2014 Argus Media Ltd. All rights reserved.

SK Lubricants

580,000 t/yr

Panjin Northern

Asphalt

400,000 t/yr

Sinopec Yanshan

240,000 t/yr

S-Oil

150,000 t/yr

Shell/Hyundai

Oilbank

650,000 t/yr

Adnoc

600,000 t/yr

SK/Repsol

630,000 t/yr

Chevron

1.25mn t/yr

Lwart

150,000 t/yr

Tatneft

200,000 t/yr

illuminating the markets

Capacity in 2014 to rise by more than 3.5mn t/yr

Copyright © 2014 Argus Media Ltd. All rights reserved.

SK Lubricants

580,000 t/yr

Panjin Northern

Asphalt

400,000 t/yr

Sinopec Yanshan

240,000 t/yr

S-Oil

150,000 t/yr

Shell/Hyundai

Oilbank

650,000 t/yr

Adnoc

600,000 t/yr

SK/Repsol

630,000 t/yr

Chevron

1.25mn t/yr

Lwart

150,000 t/yr

Tatneft

200,000 t/yr

illuminating the markets

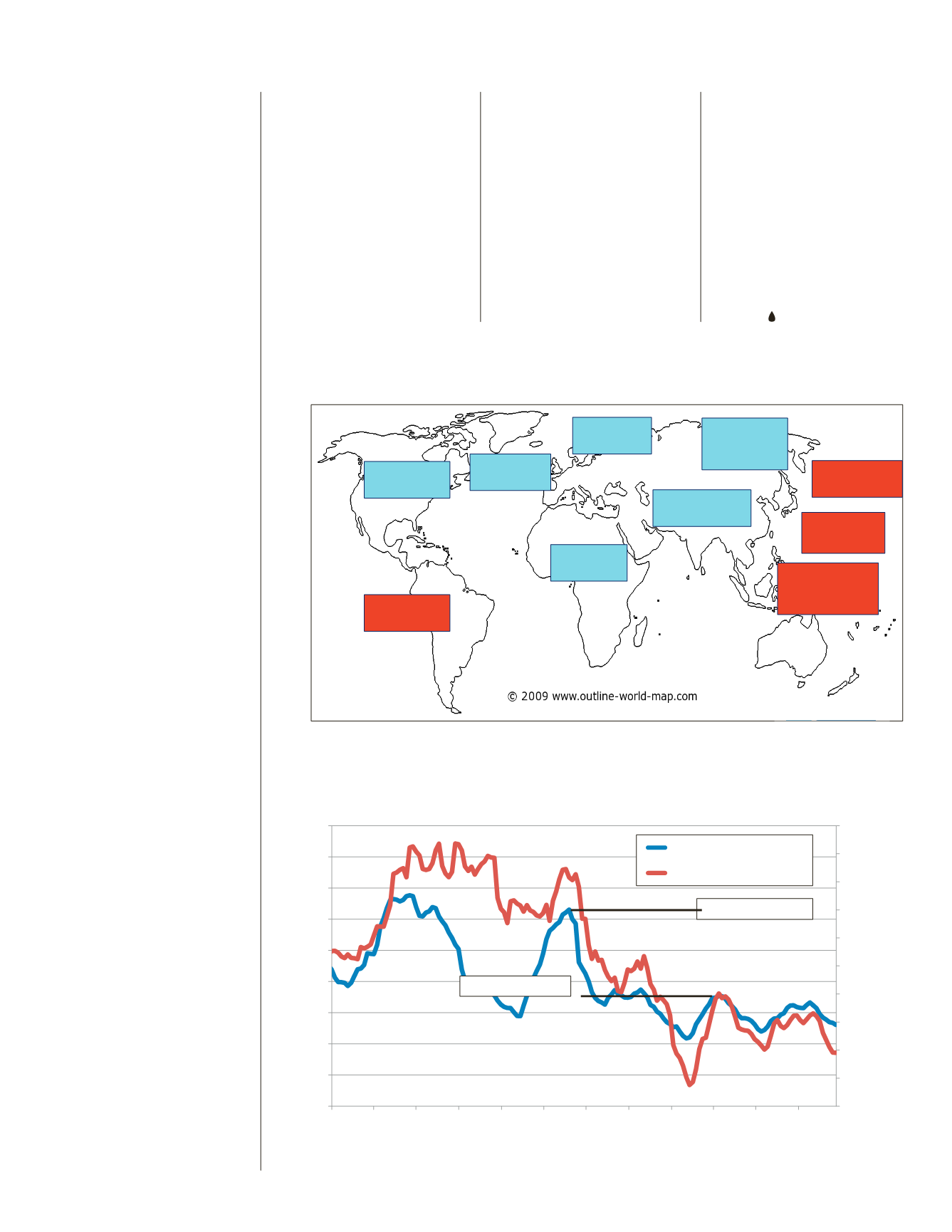

Base oil margins face sustained pressure

Copyright © 2014 Argus Media Ltd. All rights reserved.

$0.00

$0.20

$0.40

$0.60

$0.80

$1.00

$1.20

$1.40

$1.60

$1.80

$2.00

$0

$100

$200

$300

$400

$500

$600

$700

$800

$900

Jan-11 Apr-11 Jul-11 Oct-11 Jan-12 Apr-12 Jul-12 Oct-12 Jan-13 Apr-13 Jul-13 Oct-13

Europe SN 150 vs VGO ($/t)

US N100 vs VGO ($/USG)

2012 peak: $630/t

2013 peak: $350/t

With regards to base oils, the same

thing is happening in Europe.

“It’s important to keep inmind

that European base oil consumption is

relatively flat in a saturatedmarket…

and everywhere European refiners

turned to [export] outlets, they saw

American competition.”

For example, Turkish imports have

been uniformly negative since 2012,

except for a short blip inmid-2012.

“Not only is overall demand for

imported base oils falling, but Russian

exports also increased by 50%. Not

surprisingly, margins were under

pressure all year.”

Margin pressures are likely to con-

tinue for European refiners, she says.

She foresees an increase in premium

quality base oils coming into Europe

through the end of 2014.

“Capacity for base oils in 2014 is

expected to rise by 3.5 million tons

per year. That’s more oil that needs to

find a home somewhere in the world,”

says George.

The U.S. alone is projected to have

a surplus of 25 million barrels in 2014.

Competition will rise for key

destinations, such as Brazil, Mexico

and Indonesia, where lubricant

consumption is growing due to

rising car ownership.

Thus, she predicts that base oil

margins will continue to be under

pressure as the base oil trade wars

intensify.

“European SN150 versus gas

oil, both of them are USD300 per

ton below their peak in 2013. In

2014, this could hit an even smaller

number.”

illumin tin the ma kets

Capacity in 2014 to rise by more than 3.5mn t/yr

Copyright © 2014 Argus Media Ltd. All rights reserved.

SK Lubricants

580,000 t/yr

Panjin Northern

Asphalt

400,000 t/yr

Sinopec Yanshan

240,000 t/yr

S-Oil

150,000 t/yr

Shell/Hyundai

Oilbank

650,000 t/yr

Adnoc

600,000 t/yr

SK/Repsol

630,000 t/yr

Chevron

1.25mn t/yr

Lwart

150,000 t/yr

Tatneft

200,000 t/yr