23

FUELS & LUBES INTERNATIONAL

Quarter Four 2014

IndIa’s oIl sector has

largely been under government

control since 1956, when the

oil industry was classified as

“schedule a,” which meant that

the government would con-

trol all its operations. then, in

1959, an act of Parliament gave

the oil and natural Gas corp.

(onGc) regulatory authority.

It was only after 1991, in a more

liberal climate, when private

players came into the picture.

controls were loosened and

private participation was al-

lowed both in the upstream and

downstream segments.

More than 20 years later,

state-owned public sector under-

takings (PsUs) still dominate the

refining segment, while reliance

Industries ltd. and essar oil

ltd., the main private players,

are focused on exports rather

than the domestic markets.

even after liberalization,

the government continued

In FY 2014, government

subsidies are expected to touch

Inr140 thousand crore (Usd

23 billion), 36% of which is the

diesel fuel component.

Diesel RegulatoRy

stanDaRDs

recent surveys, such as those

by the World health organiza-

tion (Who), ranked the Indian

capital, new delhi, as having the

“world’s worst air quality” with

PM2.5 and PM10, annual means

at 153 μg/m

3

and 286 μg/m

3

,

respectively, way above Who’s

acceptable norms of 10 μg/m

3

and 20 μg/m

3

, respectively.

a major pollutant in diesel

fuel is sulphur. In 1995, the

sulphur content of diesel was

more than 10,000 parts per mil-

lion (ppm) nationwide. today,

the maximum allowable sulphur

content in diesel fuel in the

national capital region (delhi)

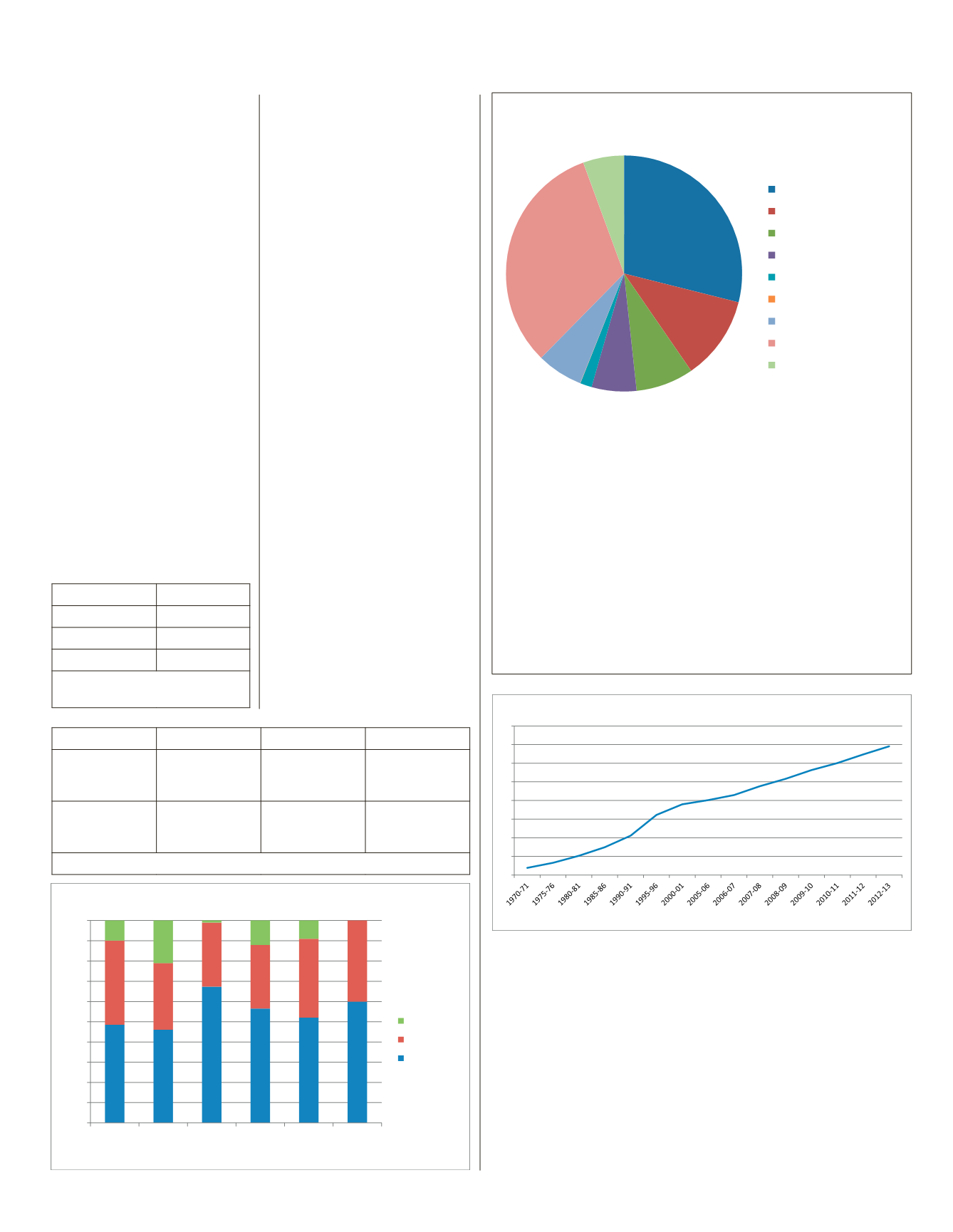

Public vs Private Sector Capacity

Source: Central Statistics Office, Govt of India

IOC (Public)

BPCL (Public)

HPCL (Public)

CPCL (Public)

NRL (Public)

ONGC (Public)

MRPL (Public)

Reliance (Private)

Essar (Private)

Public vs Private Sector Capacity

Source: Central Statistics Office, Govt of India

IOC (Public)

BPCL (Public)

HPCL (Public)

CPCL (Public)

NRL (Public)

ONGC (Public)

MRPL (Public)

Reliance (Private)

Essar (Private)

Installed Capacity (TMTPA*)

54,200

21,500

14,800

11,500

3,000

66

11,820

60,000

10,500

Refinery

IOC (Public)

BPCL (Public)

HPCL (Public)

CPCL (Public)

NRL (Public)

ONGC (Public)

MRPL (Public)

Reliance (Private)

Essar (Private)

* Thousand metric tonnes per annum

3.84 6.6

10.35

14.89

21.14

32.26

37.96 40.19 42.9

47.67

51.67

56.32

60.07

64.75

69.08

0

10

20

30

40

50

60

70

80

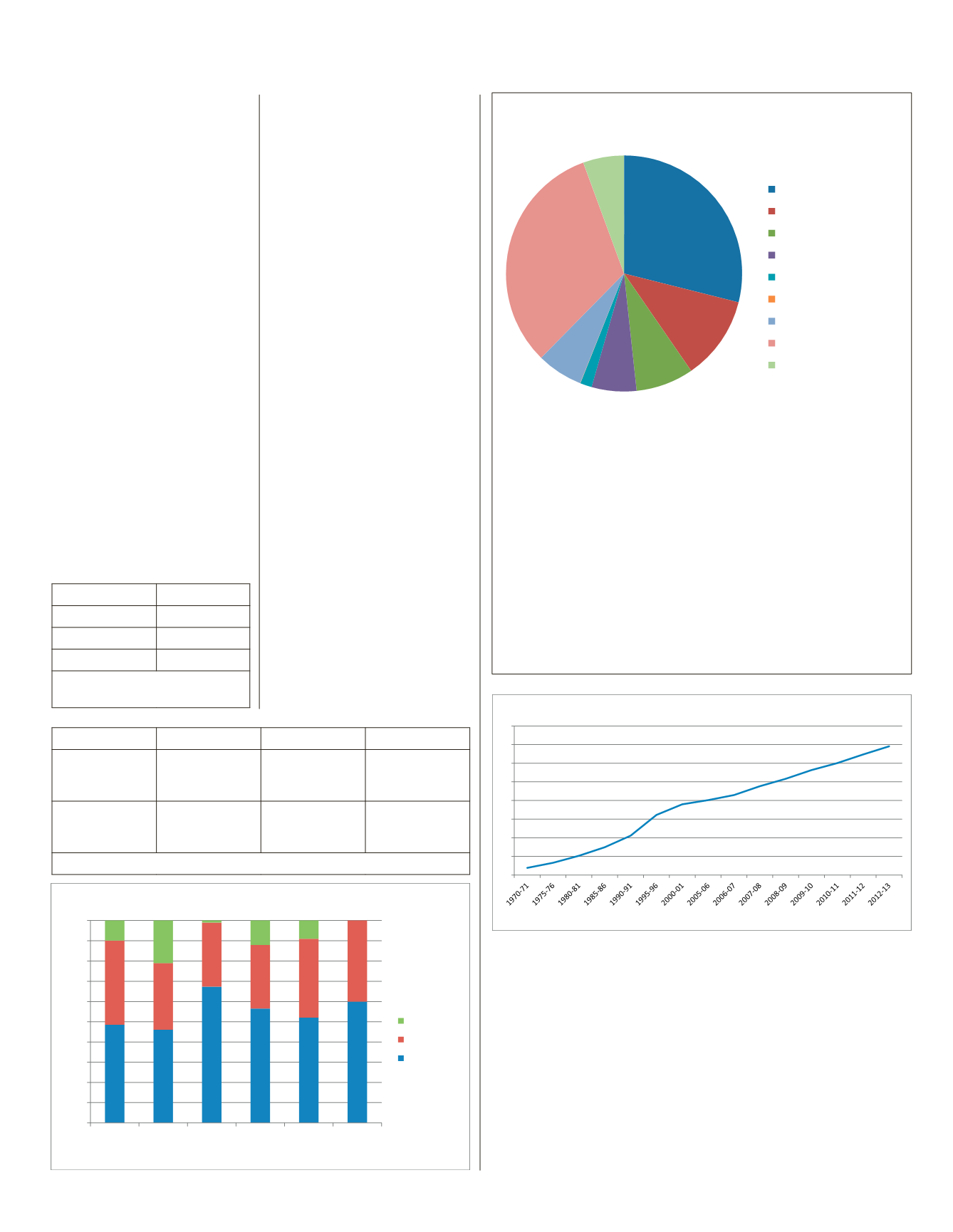

Source: Petroleum Planning and Analysis Cell, Government of India

Diesel Consumption (million tons)

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2006-07 2007-08 2008-09 2009-10 2010-11 2011-12

Source: Oxford Institute for Energy Studies

Under Recoveries Sharing Structure

OMC

Upstream

Government

Bs ii

Bs iii

Bs iV

implementation

Date

2001 (selected

cities), 2005

(nationwide)

2005 (selected

cities), 2010

(nationwide)

2010 (selected

cities)

total sulphur,

max mg/kg

(ppm)

500

350

50

Source: Central Pollution Control Board , Government of India

emission norms PM (g/km)

BS4

0.06

BS5

0.0045

% less

93

Source: International Refereed

Journal of Engineering and Science

to subsidize and control the

prices of petroleum products.

In 2002, it took important steps

for a phased dismantling of the

administered Price Mechanism.

Yet economic and political

ramifications ensure that diesel

fuel prices will continue to be

partly regulated even though

petrol prices are near parity

with market prices. a sudden

increase in diesel cost could

have been detrimental to certain

sectors, freight and agricultural

in particular, hence the decision

to hike diesel prices slowly over

time.

as a result of being cheaper

than petrol, diesel fuel became

the transport fuel of choice.

thus, India’s diesel fuel con-

sumption has risen steadily with

a compounded annual growth

rate (caGr) of 7% for the past

three and a half decades.

diesel fuel subsidies have

distorted the market, especially

after 2010 when petrol prices

were deregulated. this led to an

artificial advantage for diesel

fuel: as people opted for the

cheaper fuel, the diesel compo-

nent of the subsidy increased

further. diesel fuel consumption

rose from 56.32 million tonnes

to 69.08 million tonnes between

FY 2009-10 and FY 2012-13.

Source: Oxford Institute for Energy Studies

Source: Petroleum Planning and Analysis Cell, Government of India

Source: Central Statistics Office, Government of India

under Recoveries s ring structure

Public vs Private sector Capacity

Diesel Consumption ( illion tonnes)

23

FUELS & UBES INTER ATIONAL

Quarter Four 2014

Ind a’s oIl sector has

large y b en under governme t

contr l since 1956, when t

oil industry was cl ssified as

“schedul a,” which meant tha

the gov rnme t would con-

trol all its operations. then, in

1959, an act of Parliament gave

the oil and natural Gas corp.

(onGc) regulatory authori y.

It was only after 1991, in a more

liberal climate, wh n private

players came into the picture.

contr ls were loosened and

private p rticipation was al-

lowed both in t e upstream and

downstream seg ents.

More than 20 years later,

state-owned public sector under-

takings (PsUs) till dominate the

refining segment, while reliance

Industrie ltd. an essar oil

ltd., the main pr vate players,

are focused on exports rathe

than t e domestic markets.

even after lib alization,

the gov rnme t co inued

In FY 2014, governme t

subsidie ar exp cted to touch

Inr140 thousand crore (Usd

23 billion), 36% of which is t e

diesel fu l comp nent.

Diesel RegulatoRy

stanDaRDs

recent surveys, such as t o e

by the World health organiz -

tion (Who), ranked th India

capital, new d lhi, as having the

“world’s worst ai quality” with

PM2.5 and PM10, annu l means

at 153 μg/m

3

and 286 μg/m

3

,

respectiv ly, wa above Who’s

acceptable norms of 10 μg/m

3

and 20 μg/m

3

, respectiv ly.

a major pollutant in diesel

fuel is sulph r. In 1995, the

sulph r content of diesel was

more than 10,00 parts per mil-

lion (ppm) natio w de. today,

the maxi um allowable su ph r

content in diesel fu l in the

nation l capital region (delhi)

Public vs Private Sector Capacity

Source: Central Statistics Office, Govt of India

IOC (Public)

BPCL (Public)

HPCL (Public)

CPCL (Public)

NRL (Public)

ONGC (Public)

MRPL (Public)

Relianc (Private)

Essar (Private)

Public vs Private Sector Capacity

Source: Central Statistics Office, Govt of India

IOC (Public)

BPCL (Public)

HPCL (Public)

CPCL (Public)

NRL (Public)

ONGC (Public)

MRPL (Public)

Relianc (Private)

Essar (Private)

Installed Capacity (TMTPA*)

54,200

21,500

14,800

11,500

3,000

66

11,820

60,000

10,500

Refinery

IOC (Public)

BPCL ( ublic)

HPCL ( ublic)

CPCL ( ublic)

NRL (Public)

ONGC (Public)

MRPL (Public)

Reliance (Private)

Essar (Private)

* Thousand metric tonnes per annum

3.84 6.6

10.35

14.89

21.14

32.26

37.96 40.19 42.9

47.67

51.67

56.32

60.07

64.75

69.08

0

10

20

30

40

50

60

70

80

Source: Petrol um Planning and A alysis Cel , Government of India

Diesel Consumption (million tons)

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2006-07 2 07-08 2 08-09 2 09-10 2010-11 20 1-1

Source: Oxford Institute for Energy Studies

Under Recoveries Sharing Structure

OMC

Upstream

Government

Bs ii

Bs iii

Bs iV

implementation

Date

2001 (selected

cities), 2005

(natio wide)

2005 (selected

cities), 2010

(natio wide)

2010 (selected

cities)

total sulph r,

max g/kg

(ppm)

500

350

50

Source: Central Polluti n Control Board , Governm nt of I dia

emission n rms PM (g/km)

BS4

0.06

BS5

0.0045

% less

93

Source: Interna io l Refere d

Journal of Engineeri g and Science

to subsidize and contr l the

prices of petrol um products.

In 2002, it took important steps

for a phased dismantling of the

administered P ice Mechanism.

Yet economic and politica

ramifications ensure that diesel

fuel prices will continue to be

partly regulated ev n thoug

petrol p ices ar near parity

with market prices. a sudden

increase in diesel cost uld

have been detrimental to certain

sectors, freight and gricultura

in particular, hence the decision

to hike d esel prices slowly ver

time.

as a re ult of being cheaper

than petrol, diesel fu l becam

the transport fuel of ch ice.

thus, India’s e el fu l con-

sumption has risen st adily w th

a comp unded annu l growth

rate (caGr) of 7% or the past

three and half deca s.

diesel fu l s bsidie have

distorted th market, especially

after 2010 when petrol p ices

were d gulated. this led to an

artificial advantage for diesel

fuel: as people t d for the

cheaper fu l, th diesel comp -

nent of the subsidy increased

further. diesel fu l consumption

rose from 56.32 million ton es

to 69.08 million ton es b twe n

FY 2009-1 and FY 2012-13.

Source: Oxford Institute for Energy Studies

Source: Petroleum Planning and Analysis Cell, Governm nt of I dia

Source: Central Statistics Office, Gov rnm nt of I dia

under R coveries s aring struc ure

Public vs Private s ctor Cap city

Diesel Consumption (million t nes)