Southeast Asia on the verge of becoming a net importer of fossil fuels

Southeast Asian nations are home to one-tenth of the world’s population. 650 million inhabitants are forecast to expand by a further 120 million by 2040, with an increasing concentration in urban areas. Fuelled by this population growth, urbanisation and industrialisation, the region’s economy is projected to double in the same period.

Speaking at the SIEW Energy Insights, Singapore – International Energy Agency Forum in October 2019, Keisuke Sadamori, director, energy markets and security at the International Energy Agency (IEA), highlighted the increasing role of Southeast Asia as a major global energy player. Having held several positions at Japan’s Ministry of Economy, Trade and Industry (METI), he identified Southeast Asia, India and China as the engine driving forthcoming global energy demand growth. Together, these three Asian regions are expected to deliver almost 60% of global energy demand increases to 2040, says Sadamori. Southeast Asia will account for 11% of growth, with a projected change in primary energy demand of 420 million tonnes of oil equivalent (Mtoe). India is the highest growth contributor, producing 26% of worldwide increases, followed closely by China (21%).

Since 2000, the Southeast Asian nations of Brunei Darussalam, Cambodia, Indonesia, Lao People’s Democratic Republic (PDR), Malaysia, Myanmar, Philippines, Singapore, Thailand and Vietnam have enjoyed an overall increase in energy demand of 60% and continue to exhibit strong future growth potential. However, alongside this impressive growth are a myriad of energy challenges, says Sadamori.

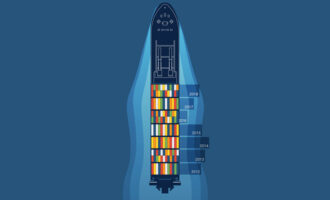

Growth in the region has been underpinned by fossil fuels, with ever-increasing dependence on fossil fuel imports, he says. Southeast Asia is on the verge of becoming a net importer of fossil fuels for the first time. By 2040, its dependence on fossil fuel imports is projected to create an energy trade deficit of more than USD300 billion per year. Rising fuel demand is far outpacing local production, with oil the primary culprit for this gargantuan import bill.

Despite a transition towards less energy-intensive manufacturing and greater efficiencies, which are expected to slow the rate of energy demand growth moving forward, Southeast Asia’s reliance on oil imports could exceed 80% by 2040, with a total demand of nine million barrels per day (mbpd), up from 6.5 mbpd today.

The Southeast Asia Energy Outlook is a biennial World Energy Outlook Special Report that outlines energy opportunities and risks facing the member countries of the Association of Southeast Asian Nations (ASEAN). The fourth edition was released on 30 October 2019. The outlook highlights promising progress in electrifying the region — Southeast Asia has the fastest electricity demand growth in the world at 6% — with universal access to electricity anticipated by 2030. Currently, 45 million Southeast Asians lack access to electricity.

The Southeast Asia Energy Outlook is a biennial World Energy Outlook Special Report that outlines energy opportunities and risks facing the member countries of the Association of Southeast Asian Nations (ASEAN). The fourth edition was released on 30 October 2019. The outlook highlights promising progress in electrifying the region — Southeast Asia has the fastest electricity demand growth in the world at 6% — with universal access to electricity anticipated by 2030. Currently, 45 million Southeast Asians lack access to electricity.

The report also warns of the continuing dependence on fossil fuels, emphasising a doubling of fossil fuel use that has occurred since 2000. Oil continues to be the largest component in the regional energy mix, with coal the fastest growing — due to ongoing application in power generation. Share of coal in the power mix increased in 2018, despite a global trend towards coal reduction, and is projected to rise steadily in future decades based on today’s policy settings. A two-thirds increase in carbon dioxide emissions by 2040, to almost 2.4 gigatonnes, comes as a result of Southeast Asia’s projected increase in fossil fuel consumption.

Despite an increase in biofuel usage and the emergence of electrified mobility, oil continues to dominate road transport demand in Southeast Asia. The outlook projects limited impact on demand from the electrification of mobility to 2040, with growth in electric two- and three-wheelers a partial exception. Since 2000, vehicle ownership in Southeast Asia has tripled, with an associated doubling of fuel consumption.

Southeast Asia has significant potential for renewable energy and can achieve a more sustainable pathway by intensifying its efforts on renewables and efficiency. The outlook’s gloomy projections are based on current policy frameworks and ambitions, alongside the evolution of known technologies.

Under today’s policies, the region’s share of renewables in primary energy demand remains flat at around 15% to 2025, well shy of the ASEAN Plan of Action for Energy Cooperation (APAEC) target of 23%. Oil continues to grow, and the contribution from renewables lags leading economies in Asia.

Under today’s policies, the region’s share of renewables in primary energy demand remains flat at around 15% to 2025, well shy of the ASEAN Plan of Action for Energy Cooperation (APAEC) target of 23%. Oil continues to grow, and the contribution from renewables lags leading economies in Asia.

Improvements in the cost and availability of renewables, and concerns around emissions and pollution, are beginning to shift the balance of future additions to the power mix. Emerging signs of change include the truth that capacity additions of solar photovoltaic (PV) exceeded approvals of new coal-fired capacity in the first half of 2019. According to the 2019 outlook, recent policy planning document updates boost the long-term share of renewables, to the detriment of coal.

During his presentation, Sadamori suggested a small increase in investment and a major reallocation of flows could set Southeast Asia on a sustainable pathway and bring multiple benefits. The 2019 Southeast Asia Energy Outlook also highlights a ‘Sustainable Development Scenario’ (SDS) explaining the requirements to meet internationally agreed sustainability goals. Under this scenario, the share of renewables in power generation reaches 70% by 2040, three times today’s levels. However, energy subsidy reform is also a significant challenge for developing Asian economies trying to shift away from an over-reliance on fossil fuels.

The future is most certainly electric in Southeast Asia — electricity consumption in Southeast Asia doubles to 2040 with an annual growth rate twice as fast as the rest of the world. Though, the SDS underlines the importance of tackling Southeast Asia’s legacy energy issues, starting with the least-efficient coal plants. In addition, the SDS highlights a need to place significant focus on improving efficiency — particularly in the fastest growing sectors such as cooling and road transport.