Future developments in the fuel additives market

By Dr. Raj Shah, David Forester, Stanley Zhang

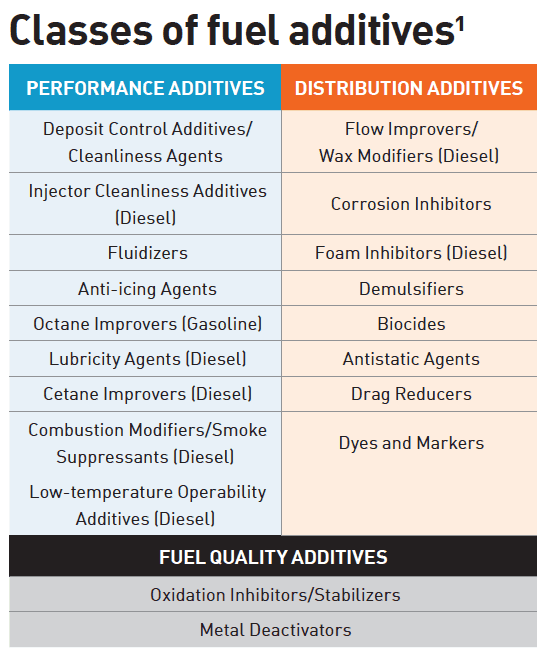

Fuel additives are chemical compounds formulated to enhance performance and correct the deficiencies of fuels used in motor vehicles. In a broad sense, they can be classified as either performance additives, distribution additives, or fuel quality additives.

Performance additives are designed to improve engine performance by:

(1) removing and preventing deposits in fuel injectors, valves, and combustion chambers

(2) boosting lubricity

(3) improving combustion efficiency

(4) improving low temperature properties

(5) reducing undesirable emissions

In contrast, fuel additives classed in the distribution category combat corrosion, foam, filter plugging, and microorganism contamination. Fuel quality additives, on the other hand, help to maintain fuel quality by inhibiting oxidation, reducing fuel degradation, and improving long-term fuel storage stability. Determining the optimal combination of additives to use is integral to long-term engine durability and lowering vehicle tailpipe emissions.

Fuel additive use has grown in popularity due to government regulations which impose stringent environmental regulations to limit greenhouse gas (GHG) emissions. Organisations like the U.S. Environmental Protection Agency (EPA), the California Air Resources Board (CARB) and the European Union (EU) have pushed the market to focus on cleaner and more efficient fuels in the United States, the U.S. state of California, and Europe, respectively. Along with efforts to reduce vehicular emissions, the implementation of gasoline direct injection (GDI) engines, the rise in demand for ultra-low sulphur diesel fuel (ULSD), and the overall expansion of the automotive industry are key factors contributing to the projected growth in fuel additives use into 2021 and the next decade.

Types of fuel additives

Performance fuel additives are composed of a wide range of compounds that target overall engine performance and efficiency. Some of the most important additives in this category are deposit control additives and cleanliness agents, which maintain engine cleanliness through deposit removal and prevention. In particular, intake valve system deposits (IVDs), combustion chamber deposits (CCDs), and fuel injector deposits (FIDs) form as a result of the thermo-oxidative degradation of hydrocarbons and are directly correlated with a decrease in engine performance.

Consequently, they are the primary focus for deposit control additives. Fluidizers are additives used in gasoline deposit control additives to enhance component compatibility within a fuel composition, usually in the form of solvents or diluents. Anti-icing agents are designed to reduce carburetor icing caused by temperature dropping from evaporating gasoline. Octane improvers are additives utilised in gasoline to increase octane levels and consequently provide protection against engine knock and reduce harmful tailpipe emissions. In the realm of diesel fuels, lubricity agents are crucial to ensure appropriate protection against frictional and corrosive wear to injection pumps. Cetane improvers boost the ignitability of diesel fuel, resulting in reductions in combustion noise, engine vibration and smoke. Combustion modifiers and smoke suppressants play a similar role in improving combustion efficiency and minimising unwanted smoke emissions. Low-temperature operability additives are also incorporated into diesel fuels to lower their pour point and enhance their cold flow properties below the cloud point of the fuel.1

Distribution additives function to protect fuels against the wide range of problems that may occur during the transportation and distribution process. Flow improvers and wax modifiers address the issue of wax crystal formation in diesel fuel at low temperatures, which can impede flow and cause filter plugging. Corrosion inhibitors are utilised to minimise the corrosion of tanks, fuel lines, injectors, and pumps. Foam inhibitors prevent foam formation during the pumping of diesel fuel into vehicle tanks, which helps to combat spillage and incomplete tank fillings. Demulsifiers expedite water separation in emulsified fuels to prevent metal corrosion and filter plugging. Microbicides are frequently used in fuel tanks where microorganism growth is evident. Antistatic agents protect against electrostatic charges during the fast pumping of fuels. Drag reducers improve the flow characteristics of low viscosity fuels and reduce the energy required to pump fuels through the pipeline. Dyes and markers assist in either visually or chemically differentiating fuel products based on production batches, grades, or applications.1

The last category is fuel quality additives, which primarily function to maintain fuel condition and prevent degradation during storage. Oxidation inhibitors and stabilizers play a fundamental role in lessening color degradation, deposit formation, filter plugging tendencies, and in improving long-term fuel storage stability. These additives combat the attack of atmospheric oxygen to prevent the formation of peroxides and gums. Metal deactivators perform a similar function in protecting against the oxidative degradation of hydrocarbons by chelating with metal ions and rendering them as ineffective catalysts.1

Current applications of fuel additives

According to the U.S. EPA, the typical passenger vehicle emits about 4.6 metric tons of carbon dioxide per year.2 With passenger vehicles composing 93% of the estimated 1.2 billion vehicles globally, the amount of carbon emissions from passenger vehicles alone climbs to a concerning total.3 Carbon emissions have risen rapidly since the Industrial Revolution, with global GHG emissions from the transportation sector at around 4.62 metric gigatons in 2016.4 Consequently, fuel additive manufacturers have focused on improving their additive formulations to meet fuel economy and emissions standards of commercial fuel blends.

In 1996, the U.S. EPA introduced the Lowest Additive Concentration (LAC) standard, which required a minimum amount of fuel detergent to be used in all gasoline sold in the United States.5 However, many automakers believe this minimum level of additives failed to provide adequate protection against deposit accumulation and their associated complications, like detonation, pre-ignition, incomplete combustion, reduced fuel economy, and increased exhaust emissions. In response, eight automakers — Audi, BMW, General Motors (GM), Honda, Fiat Chrysler Automobiles, Toyota, Mercedes-Benz, and Volkswagen — established Top Tier in 2004.6 This voluntary program introduced a higher standard for gasoline detergent additives and increased the concentration of certified detergents in fuels for the purpose of raising fuel quality and optimising engine performance.

According to a study conducted by the American Automobile Association (AAA), the use of Top Tier gasoline resulted in 19 times fewer intake valve deposits (IVDs) compared to non-Top Tier gasoline. Additional research showed that the long-term use of non-Top Tier gasoline could lower fuel economy savings by 2-4%.7 Outstanding results from the use of Top Tier gasoline convinced 54 fuel retailers to offer Top Tier gasoline around the world. Participating retailers include major players, such as ExxonMobil, Chevron, BP, Shell, and Sunoco. At these locations, gasoline across all grades, from regular to premium, must comply with Top Tier specifications.

Tetraethyl lead (TEL) was commercially used as an octane booster for gasoline, but was eventually banned by the U.S. EPA in 1996 due to public health concerns. Afterwards, commercial oxygenates, such as methyl tertiary butyl ether (MTBE), became the favored octane improver. MTBE raises octane ratings by increasing the oxygen content of motor gasoline and thereby facilitating gasoline combustion and reducing tailpipe emissions. Oxygenates are utilised in reformulated gasoline (RFG) for cleaner combustion and lower emissions, a requirement of the Clean Air Act of 1963 in cities with heavy air pollution. However, the U.S. EPA had drafted plans to eliminate the use of MTBE in the early 2000 after discovering its higher water solubility and its potential to contaminate water supply should underground storage tanks develop leaks. The Energy Policy Act of 2005 eliminated the oxygenate requirement for RFG which prompted refiners to use ethanol to boost the octane rating of gasoline instead of using MTBE.8

The most common ethanol blend in gasoline in the market today is 10%, known as E10. There are limits imposed on the amount of oxygenates in gasoline due to their tendency to form deposits and impact Reid Vapor Pressure (RVP), a common measure of the volatility of gasoline and other petroleum products. The current U.S. limit for ethanol in gasoline is 10%, but the U.S. EPA has been pushing for the sale of gasoline containing 15% ethanol (E15) year-round. The sale of E15 is banned between June and September due to the possibility of increased particle emissions during the summer. E15 has an octane rating of 88 Research Octane Number (RON), at a lesser cost than 87 RON, but has only been approved for use in flexible fuel vehicles and model year 2001 or newer.9 There is expectation that new legislation regarding the year-round sale of E15, which the current Trump administration has been pushing for, would allow for its increased availability in more U.S. states.

The future of fuel additives from 2021 and beyond

The growth of the automotive industry, and as a consequence the growth in global fuel consumption, drives fuel additives demand. The United States is expected to dominate the fuel additives market moving forward into 2021. This is supported by the fact that the United States is the second largest market for vehicle sales and production globally. According to the U.S. Energy Information Administration (EIA), the U.S. consumed about 3.39 billion barrels of motor gasoline in 2019. Meanwhile, diesel fuel consumption by the transportation sector was 1.1 billion barrels, accounting for 15% of total petroleum consumption in the country.11 These numbers are expected to grow in 2021, with corresponding growth in the fuel additives market, despite the hiccup in 2020 due the global Covid-19 pandemic. Other markets, such as China, Europe, India, and South Korea are expected to grow as well, although the growth of electric vehicles could have a negative impact on fuel demand.

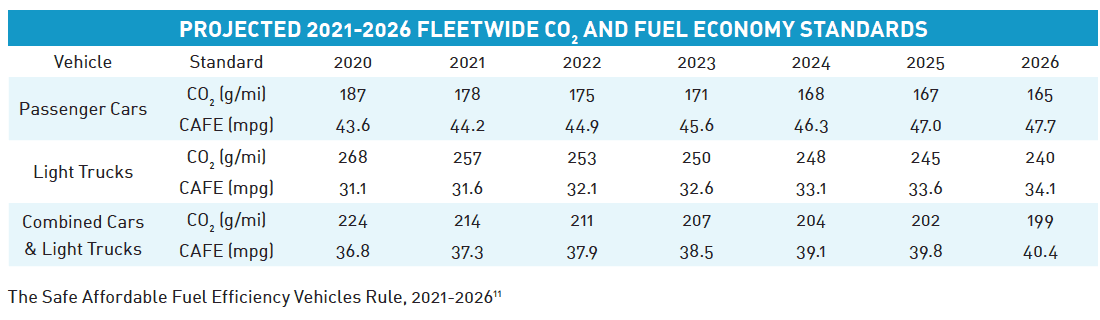

In the past, more stringent environmental regulations have boosted demand for fuel additives. The U.S. EPA plays a key role in the monitoring and commercialisation of fuel additives. In March 2020, the U.S. EPA and the National Highway Traffic Safety Administration (NHTSA) issued new standards regarding greenhouse gas emissions and fuel economy requirements for passenger vehicles and light-duty trucks. Dubbed as the Safer Affordable Fuel Efficiency (SAFE) Vehicles Rule, the new standards, which are being challenged in court by several U.S. states, require automakers to improve fuel efficiency by 1.5% annually from model years 2021 to 2026. By 2025, automakers must reduce CO2 emissions to under 202 grams per mile and improve fuel economy to at least 39.8 miles per gallon for cars and light trucks. This new rule is actually a setback from the previously established standards by the Obama administration of 5% annual fuel efficiency improvements, with an objective to reach 46.7 miles per gallon by 2025.12

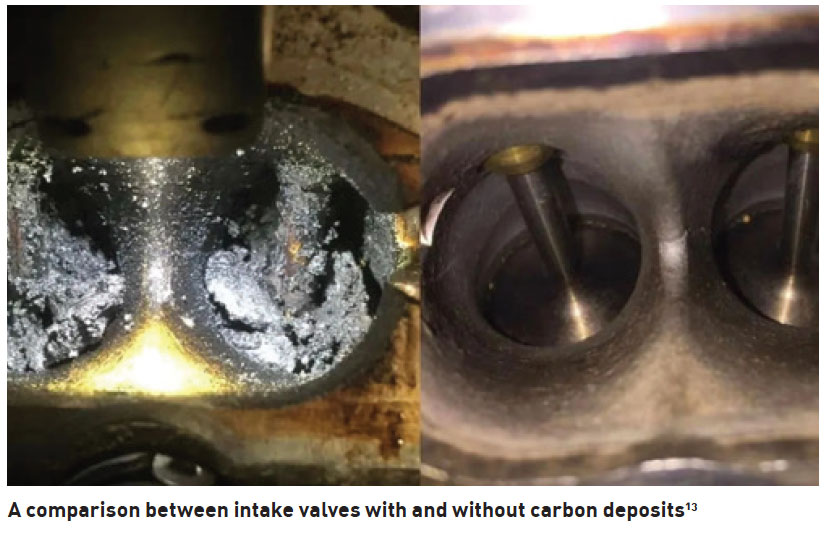

Gasoline consumption is expected to pick up again post-Covid 19 to meet the requirements of evolving gasoline engine technology. Currently, the use of deposit control additives and octane improvers in gasoline are major contributors to rising additives consumption because of the need for more efficient fuel for modern engines. GDI systems have become the standard in newer, high-performance vehicles with internal combustion engines. In contrast to traditional port injection fuel delivery systems, GDI engines have injectors placed directly inside the combustion chamber, which yields improved combustion, enhanced performance, better fuel mileage, and lower vehicle tailpipe emissions. However, GDI engines are prone to carbon deposit buildup on intake valves because the gasoline is directly injected into the cylinder. This necessitates the use of higher amounts of deposit control additives.

In addition, the development and commercialisation of fuel additives from renewable resources is expected to generate new opportunities for the fuel additives market. The French-German company, Global Bioenergies, has been producing two high-performance fuel additives, namely, isooctane and ethyl-tert-butyl ether (ETBE), from bio-based isobutene. Isooctane and ETBE are utilised in gasoline blends as octane improvers with high octane ratings equal to or higher than 100, yielding high-renewable-content fuels with better knock resistance.13

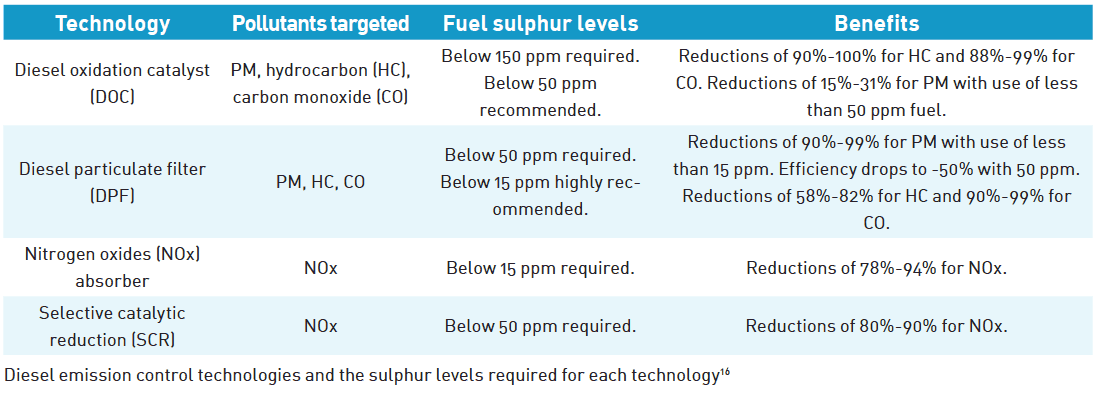

Due to increasing demand for ultra-low sulphur diesel fuel, demand for diesel fuel additives is also expected to grow. ULSD is a cleaner burning diesel fuel with a maximum sulphur content of 15 parts per million (ppm), allowing for the development of high-pressure common rail (HPCR) fuel injection systems that have significantly improved combustion efficiency and greatly reduced emissions. ULSD has enabled the application of emission control devices that drastically reduces particulate and gaseous emissions from diesel combustion. In the United States, the use of ULSD has been a requirement for highway vehicles since 2006 and eventually became necessary for locomotive, marine, and non-road engines, burners (home heating oil) and equipment.15

However, fuel lubricity has been an issue since the introduction of ULSD, as sulphur provides natural lubricity to diesel fuel. In addition, ULSD is less water soluble than traditional diesel fuel, which makes it prone to water separation, microbial contamination, and accelerated tank corrosion. Similarly, the use of 5-20% biodiesel blends makes diesel fuel more prone to water contamination, which can increase the incidence of microbial contamination and subsequent filter plugging and accelerated tank corrosion.16 Consequently, additives, such as lubricity improvers and corrosion inhibitors, are necessary additions to ULSD. These additives improve the performance of ULSD.

Scheduled to take effect in January 2021, China will only allow the sale of diesel fuel that are compliant with China VI standards, which requires a maximum sulphur limit of 10 ppm.17 As countries continue to tighten their fuel standards due to growing environmental concerns, the demand for ULSD is bound to increase, and along with it, the demand for diesel fuel additives.

The development of HPCR fuel injection and other advanced engine technologies, is boosting demand for cleaner fuels. Use of additives to prevent and/or remediate water and microbial contamination, as well as prevent and/or remove injector deposits, is expected to grow. The winter season use of low temperature operability additives will continue to grow as well as biodiesel blends continue to increase in certain markets.

The fuel additives market for aviation fuels is forecasted to steadily grow along with the resumption of air travel and growth in air cargo, post-Covid 19. According to the U.S. Federal Aviation Administration (FAA), the active general aviation fleet is expected to slightly decline by 0.9% between 2020 and 2040, but the number of general aviation hours flown is projected to increase by 16% or an average of 0.7% per year.18 Post-Covid 19, the long-term outlook for aviation is generally considered to be stable and profitability is expected to rise, as global economies resume their growth in 2021, once the global Covid-19 pandemic is under control.

Consequently, the consumption of aviation fuels and their respective additives should experience relative growth. Conventional jet fuel is based on either unleaded kerosene (Jet A-1) or a naphtha-kerosene blend (Jet B), which are primarily used in modern commercial airliners and military aircraft, respectively. Additives, like metal deactivators, antioxidants, and corrosion inhibitors, are commonly added to jet fuel to improve thermal stability, reduce weathering, and increase lubricity. Aviation gasoline (avgas) is another type of aviation fuel used by small aircraft and vintage piston-engine aircraft.19 However, unlike motor gasoline, most grades of avgas still contain TEL as an octane booster to prevent engine knocking. Currently, there are ongoing experiments to eliminate the use of lead from aviation fuels. Thus, it is likely that future aviation additives would see developments in that direction.

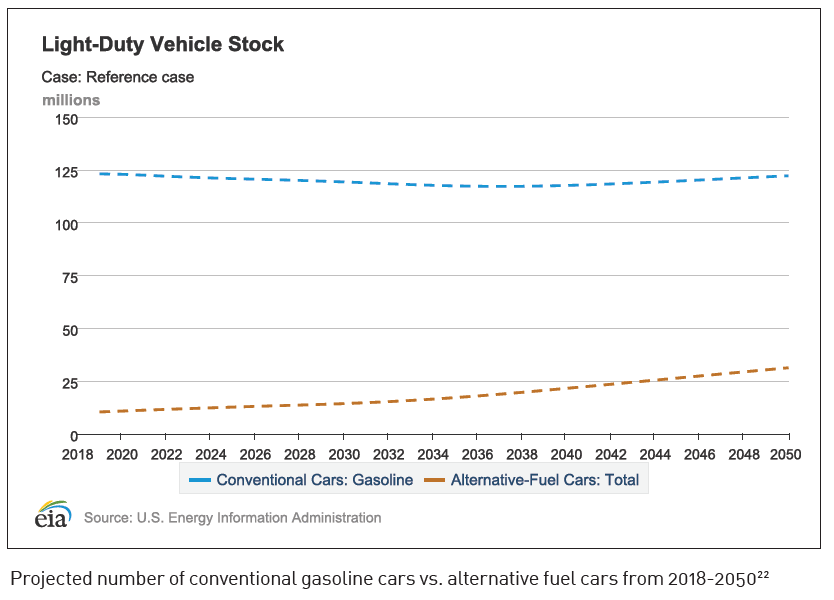

Although the fuel additives market is projected to grow from 2021 onwards, post-Covid 19, the rise in demand for sustainable aviation fuels (SAF) are likely to restrain growth. The global pandemic has led to an economic recession. Lockdown and social distancing have led to a sharp decline in economic activity, mobility, and thus, fuel consumption.20 In addition, increasing concern over climate change has shifted the attention towards alternative or renewable fuels. Alternative fuel vehicles (AFV), such as compressed natural gas (CNG) vehicles and liquified petroleum gas (LPG) vehicles, reduce tailpipe emissions by approximately 60-90% when compared to reformulated gasoline vehicles. Also, plug-in hybrid electric vehicles (PHEVs) and all-electric vehicles (EVs) are growing in popularity. Several countries have mandated zero-emission vehicles as early as 2030.21 China has dominated the global EV market, with emphasis on electrifying two/three-wheelers and urban buses to address air quality concerns in densely populated cities.22 Europe is in second place, with EV sales rising to match CO2 emissions standards. The U.S. is somewhat lagging. According to the U.S. EIA, the projected number of alternative fueled cars in 2021 will rise to 11.05 million units compared to the 122.31 million for conventional gasoline cars.23

Projected number of conventional gasoline cars vs. alternative fuel cars from 2018-205023

References

¹ Syed, Rizvi, editor. “A Comprehensive Review of Lubricant Chemistry, Technology, Selection, and Design.” ASTM International, 2009.

² “Global Greenhouse Gas Emissions Data.” United States Environmental Protection Agency.

³ Voelcker, John. “1.2 Billion Vehicles on World’s Roads Now, 2 Billion by 2035: Report.” Green Car Reports. 29 July 2014.

⁴ Wang, Shiying, and Ge, Mengpin. “Everything You Need to Know About the Fastest-Growing Source of Global Emissions: Transport.” World Resources Institute. 16 October 2019.

⁵ Carley, Larry. “Deposit Control Additives and Bad Gas.” Underhood Service. 1 October 2016.

⁶ Bartlett, Jeff S. “Study Shows Top Tier Gasoline Worth the Extra Price.” Consumer Reports. 3 April 2019.

⁷ “Proprietary Research into the Effectiveness of Fuel Additive Packages in Commercially-Available Gasoline.” American Automobile Association. 2016.

⁸ “A Brief History of Octane in Gasoline: From Lead to Ethanol.” Environmental and Energy Study Institute. March 2016.

⁹ Wald, Ellen R. “Trump’s New Ethanol Rule Explained (And What It Means For Gasoline).” Forbes. 9 October 2018.

10 “3 Explanations That Will Reduce Customer Confusion About E15.” CSP Daily News. 9 April 2019.

11 “Fuel Additives Market – Growth, Trends, and Forecast (2020 – 2025).” Mordor Intelligence. 2019.

12 “Federal Vehicle Standards.” Center for Climate and Energy Solutions. May 2020.

13 “First Car Driving with Global Bioenergies’ Renewable Gasoline.” Global Bioenergies. 5 April 2018.

14 “Time for Detox – Carbon Build Up Cleaning and Nuts.” Euro Surgeon.

15 “New Ultra Low Sulfur Diesel fuel and New Engines and Vehicles with Advanced Emissions Control Systems Offer Significant Air Quality Improvement.” American Petroleum Institute.

16 Courville, Caleb. “Ultra Low Sulfur Diesel (ULSD): the Good, the Bad, and the Rusty.” Axi International. 18 July 2018.

17 Yang, Liuhanzi. “Motor Vehicle Diesel Fuel Quality Compliance and Enforcement in China: A look at the Status Quo and International Best Practices.” International Council on Clean Transportation. March 2020.

18 “FAA Aerospace Forecast.” Federal Aviation Administration.

19 “Jet Fuel Additives.” Shell.

20 “Fuel Additives Market by Type, Application – Global Forecast to 2025.” Markets and Markets. June 2020.

21 Electric Vehicle Benefits and Considerations.” Energy Efficiency & Renewable Energy.

22 “Global EV Outlook 2020.” International Energy Agency.

23 “Annual Energy Outlook 2020.” U.S. Energy Information Administration.