Automotive Lubricants: A pivot to Asia

By Eugene Tan, GXS Partners

The automotive lubricants industry will pivot to Asia. Fundamental forces have emerged and are coming together to drive significant change. Only those who understand the forces and position themselves will not just survive but also grow in Asia.

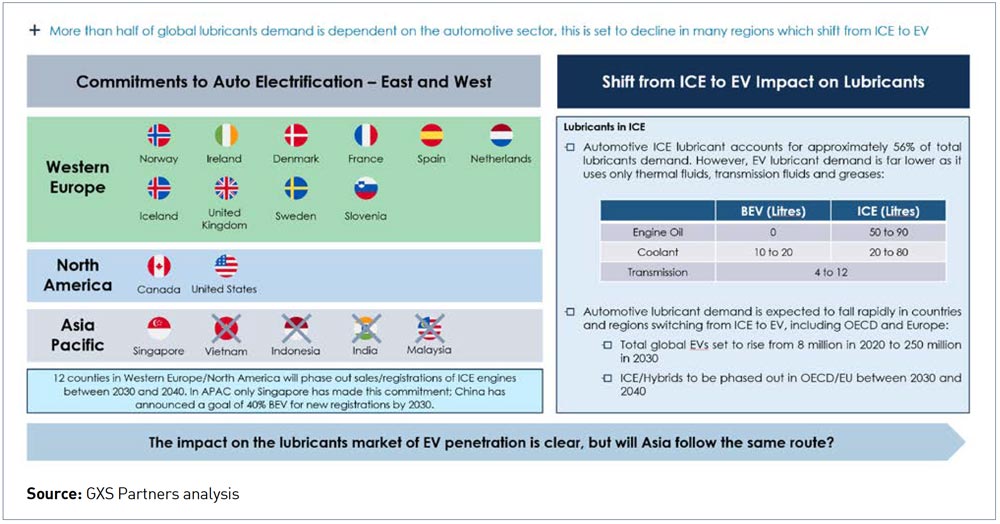

The internal combustion engine (ICE) consumes more than 50% of total lubricants, primarily in engine oils and transmission fluids. However, environmental pressures are driving rapid adoption of electric vehicles (EV) and potentially hydrogen fuel cells. Neither use engine oils and they both consume significantly less transmission fluids and coolants.

Incentives and regulations in OECD and China are expected to drive increased EV registrations as a percentage of new vehicles to between 50-75% per year by 2030 with outright bans in some countries by 2040.

What about Asia?

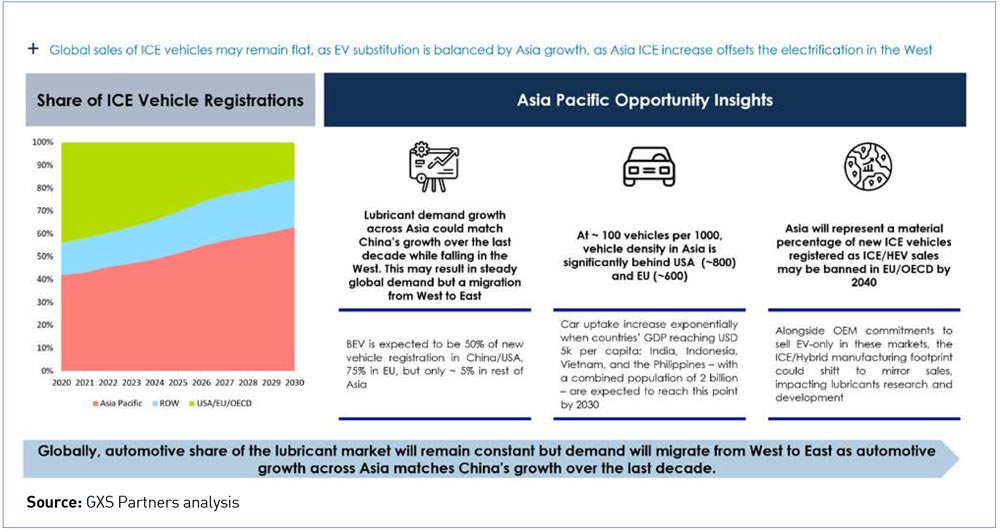

Vehicle demand for mobility is set to continue to increase as more Asian developing countries reach the USD5,000 tipping point in per capita GDP where vehicle registrations increase exponentially. Asia currently has over 400 million motorcycles, many of whose owners aspire to upgrade to cars. On average there are 100 vehicles per thousand people in Asia, versus 800 in the U.S.A. and 600 in Europe. Indonesia, Philippines, India and Vietnam, which are some of the most populous countries in Asia, currently have a combined average of less than 50 vehicles per thousand. They will reach the tipping point by 2030. So expect similar growth to that experienced in China over the last 10 years.

Apart from Singapore, which will ban ICE vehicles by 2030, developing Asia has been relatively quiet with regards to their position towards incentivizing or legislating EV adoption. The average EV incentive in China/OECD costs their governments about USD10,000 per vehicle to compensate for the higher cost. And cost of vehicle ownership and use is politically sensitive with many Asian governments subsidizing fuel costs, so legislation without incentives is doubtful.

We believe EV adoption will neither be incentivized nor legislated except in selected major cities. Sovereign resources are limited. Even more so now as governments struggle with the debt burden created by the Covid-19 pandemic, and the need to prioritize development for the more marginalized members of society. Choices have to be made. Key amongst them,

- Electricity in Asia is generated primarily from coal, and will remain predominantly coal-driven with about 80% of new coal power plants currently being built in Asia. We believe Asian governments could contribute more to the environment by investing in greener electricity generation, and replacing coal power plants than by incentivizing EV sales. Asia is also short of electricity. Even without vehicle electrification, electricity generation must increase to meet basic necessities like lighting, domestic cooling, cooking and refrigeration. Despite the rapidly emerging middle class, income inequality results in hundreds of millions in Asia without access to stable and sufficient supply of electricity. So it is expected that governments will prioritize building electricity generation capacity to meet basic needs before encouraging the wealthy to adopt EVs and thereby putting more pressure on the base load.

- Electricity transmission infrastructure is also inadequate with up to 20% losses in Asia versus less than 5% in developed countries. This has to be factored into the calculation of the environmental impact of mobility electrification.

Consequently, we believe that at best governments will encourage better fuel economy vehicles like hybrids, instead of EVs, and thus Asia’s vehicle growth will result in continued ICE demand growth.

Global automotive demand balance

With the decline of ICE demand in the West and increase in vehicle demand in Asia without incentives or legislation in favor of EVs, the net result will be a significant swing in ICE demand, whereby Asia could exceed 60% of ICE registrations by 2030. Furthermore the growth in Asian demand will mean that total global ICE registrations may remain constant.

Industry players should monitor developments closely to ensure that they are not blinkered by an EV-only perspective and be able to respond to this shift should it materialize. Areas to monitor cover the entire ESG and automotive ecosystem including automotive manufacturers, power generation funding and recharging infrastructure. And also distinguish between developments in primary cities from the rest of the country. Furthermore the industry should review the lifecycle use of lubricants to ensure that they comply with any Scope 3 implications on packaging and used lubricants Disposal.

This will have implications on at least investments in plants, resources, R&D, and partnerships over the years to come. And some companies will be better placed to respond than others, depending on their footprint in different countries and existing partnerships with automotive players who continue manufacturing ICE vehicles. Furthermore, there will be different responses by National Oil Companies, International Oil Companies and independents due to strategic perspectives, stakeholders and ESG commitments. This could lead to different strategic responses giving rise to M&A opportunities.

Consequently we believe that a review of the environment, an analysis of future state scenarios and an understanding of future opportunities can be developed to position the industry as a whole and individual companies to succeed in Asia.