IHS Markit Identifies Five Billion Barrels of Oil Equivalent in ’Short-Cycle’ Opportunities Outside North America

Late basin-life discoveries provide operators a source of free cash

flow and capital flexibility in a low-cost path to production

HOUSTON–(BUSINESS WIRE)–New energy research from business information provider IHS

Markit (Nasdaq: INFO) has identified more than five billion barrels

of oil equivalent (BOE) in numerous smaller, previously bypassed, or

underperforming reservoirs outside North America that offer oil and gas

operators a ’shorter-cycle’ path to production than new, frontier

projects in undeveloped areas.

The IHS Markit report, entitled: “Back to the Basins: International

Shorter-Cycle Opportunities,” initially assessed five, short-cycle

projects outside the U.S. in mature, late-life basins in Mexico,

Nigeria, Egypt, Brazil and the North Sea, and included both shallow

water and mature, onshore areas that break even at per-barrel costs

under U.S. $40.

“These five case studies represent just a fraction of the opportunity

that we identified globally,” said Kareemah

Mohamed, associate director, Plays and Basins research at IHS

Markit, and author of the analysis entitled “IHS Markit Back to the

Basins: International Shorter-Cycle Opportunities.” “Stagnant

oil prices continue to limit large-scale investments in global

exploration worldwide, including deepwater plays, and many onshore U.S.

projects are not yet cash-flow positive, so energy investors are

demanding financial returns,” she said. “These investors want to see

companies demonstrate greater capital discipline and growth while living

within their cash flow. The focus has moved away from simply reserves

capture, to production growth, and now to value maximization. In this

environment, reduced tolerance for exploration risk persists.”

Cognizant of this “new normal” E&P environment, Mohamed said she

embarked on a study that assessed mature, producing basins with a goal

of helping operators identify less capital-intensive, shorter cycle-time

projects. Projects, Mohamed said, that would enable operators to reduce

risk by leveraging both existing basin infrastructure and their unique

capabilities in plays outside the U.S. and Canada.

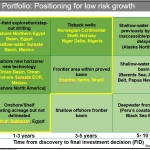

IHS Markit defines shorter-cycle projects as those that can generate

first cash within one to two years of development, or, in the case of

new entrants, projects that progress to final investment decision (FID)

in less than three years. The typical deep-water project averages seven

years to reach FID with exponentially more upfront investment.

The key screening criteria to identify these targets and minimize

investment risk, Mohamed said, were shallow-water shelf areas and

onshore mature fields—basins with a proven hydrocarbon system. In

addition, these areas had to have existing production and infrastructure

(wells [and associated production and well data], pipelines, platforms

and gas plants) in place.

With these basins identified, the next step was to look at a combination

of above ground and sub-surface risks to pinpoint avenues for new-basin

entry. Mohamed identified such opportunities that could allow for

incremental added production volumes, but also provide a source of free

cash flow to the operator.

“Due to the changing investor sentiment toward value maximization and a

reduced tolerance for risk, as well as the nature of these shorter-cycle

projects in mature basins, it was essential to advance the research

approach from one of a project-by-project basis to a whole-basin

strategy,” said Jerry Kepes, executive director for Plays and Basins

research at IHS Markit. “We’ve observed that the best results occur when

operators target basins with materiality and two or more working

petroleum systems, stacked reservoirs, existing infrastructure,

service-sector capacity and technical knowledge.”

Mindful of these market dynamics, Kepes said he and his IHS Markit

researchers see this shift to whole-basin strategies as being critical

to operators achieving competitive performance, representing a

fundamental shift in the approach to analysis and company strategies

going forward.

“Whole-basin strategies can include ‘field growth’ where the focus is on

targeting new barrels in old fields, but can also include upfront, new

ventures work that targets shorter-cycle barrels in under-explored areas

in existing commercial basins,” Kepes said. “Some of those mature basins

present fresh opportunities for operators because an E&P opening makes

new acreage available.”

Mohamed’s research included case studies on Oman and the Egyptian

offshore Western Desert, but she also identified basins that were

previously off-limits due to political instability, or those previously

overlooked because of single operator (typically state-owned) access,

stringent regulatory terms, or bureaucratic barriers, but now offer more

favorable terms and are open to foreign investment. Additional examples

of shorter-cycle development opportunities now available include basins

in Mexico.

Eni’s new entry into Mexico’s mature, shallow-water Sureste Basin is one

example. The Area 1 discovery (1.4 billion BOE) was made in an

underexplored area of the Sureste Basin, with first oil targeted for

2019, just two years after discovery. Through leveraging existing basin

infrastructure, the project’s expected break-even cost should be below

U.S. $40 per barrel, according to IHS Markit *(Source: IHS Vantage).

“This new-ventures screening alternative provides targets that offer

operators a lower-cost path to free cash-flow in a shorter period, but

also the potential for repeatable investment opportunities over time,”

Mohamed said. “In the current economic environment, this makes the

short-cycle opportunities very intriguing to operators, so we are

currently expanding the initial research to include more basins.”

To speak with Kareemah Mohamed or Jerry Kepes, please contact Melissa

Manning at [email protected].

For more information on the analysis entitled, “IHS Markit Back to

the Basins: International Short-Cycle Opportunities,” please contact [email protected].

About IHS Markit (www.ihsmarkit.com)

IHS Markit (Nasdaq: INFO) is a world leader in critical information,

analytics and solutions for the major industries and markets that drive

economies worldwide. The company delivers next-generation information,

analytics and solutions to customers in business, finance and

government, improving their operational efficiency and providing deep

insights that lead to well-informed, confident decisions. IHS Markit has

more than 50,000 business and government customers, including 80 percent

of the Fortune Global 500 and the world’s leading financial

institutions. Headquartered in London, IHS Markit is committed to

sustainable, profitable growth.

IHS Markit is a registered trademark of IHS Markit Ltd. and/or its

affiliates. All other company and product names may be trademarks of

their respective owners © 2018 IHS Markit Ltd. All rights reserved.

Contacts

IHS Markit

Melissa Manning, +1 713-906-2901

[email protected]

or

Press

Team, +1 303-305-8021

[email protected]

Follow

@IHS_News

.jpg)